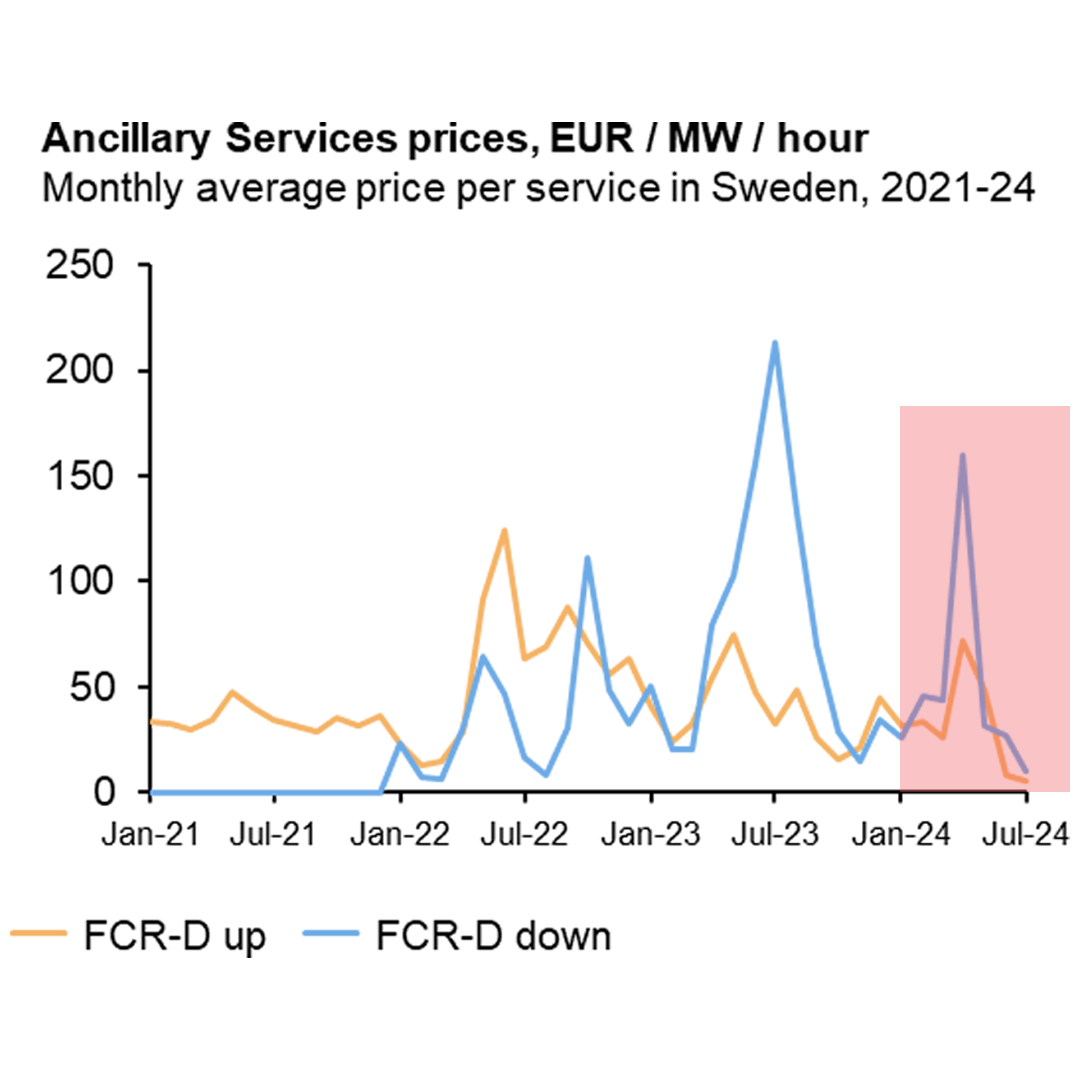

It’s no secret that the compensation level in the FCR-D market has made significant downturns this summer. In August of 2024, the levels were down to only 5% of what was registered in April of 2024, leaving many unsettled about what the future may hold. So what is driving this change, what could be learned from it, and how does this impact the future of the ancillary market, and the revenue possibilities for energy producers and battery owners?

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2024%2F09%2FBredhalla-1000x1246-1.jpg)

In the past few years, renewable energy sources have been gaining ground rapidly in energy systems around the world. Particularly wind and solar are being built at a record pace, yet these energy sources depend on the conditions of the weather, leading to increased volatility in the grid and price fluctuations. Currently, the prices on the Swedish ancillary markets, which deal with services that help regulate the grid volatility, are the lowest they have been for years. This follows a period of steady price levels since the launch of the two markets, FCR-D Up and Down.

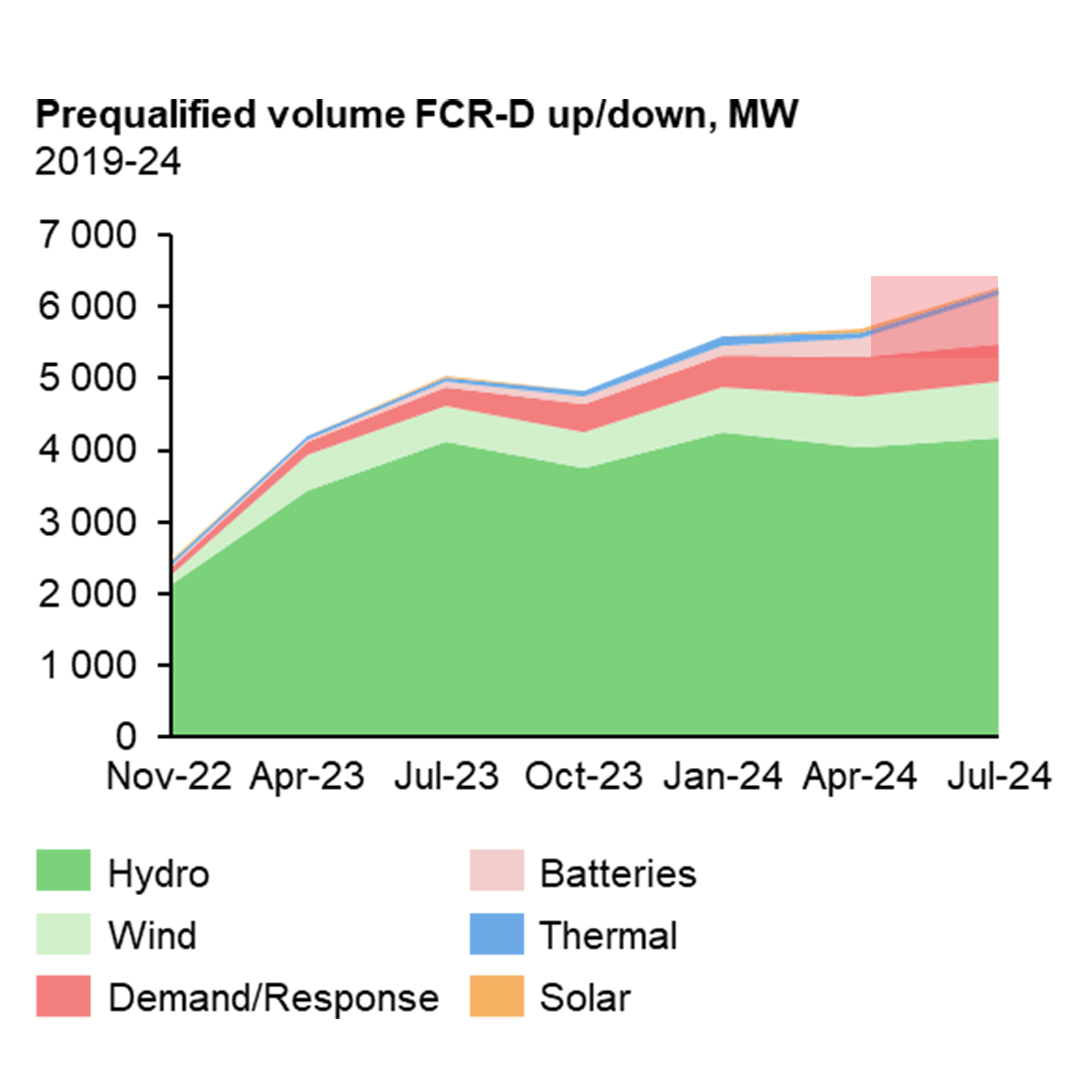

There are several important factors that have contributed to the price drops on the FCR-D market in recent months. For one, there has been a widespread battery boom in Sweden. The volume of prequalified batteries has increased almost fivefold from January to July, going from 80 MW 350 MW in battery capacity. This, in combination with an accelerated wind power growth, has led to increased competition in the ancillary markets, resulting in severe price drops.

Another thing to consider is the recent changes on the hydropower market, with an availability that has rarely been as high as it is now. Hydropower producers have, during the last few months, been able to offer ancillary services at a marginal cost at just around 10-20% of the electricity spot price. The reason for this could be traced to abundant water reserves, ideal weather conditions and decreased production costs for coal and gas in Europe that have been pushing producers to fully exploit hydropower generation.

Due to the recent developments, competition on the market is ramping up which makes price predictions more complex in the future. It is likely that the prices this summer are not particularly representative of the coming year, but the same goes for the higher prices in April. There is, however, no longer any doubt that the underlying trend has now turned downward and is clearly falling. While the prices are likely to rebound in the fall and winter, the prices at a 5-10 year perspective are expected to be similar to the levels seen this summer. In contrast to previous years, when simply being a part of the market resulted in high profits, energy producers and battery owners now need to look for alternative revenue sources to reach competitive compensation levels.

In a nutshell, prices on the FCR-D markets are declining from the extreme levels seen during 2022-2023. It can be seen as a healthy progression, leading to a mature market with more flexible energy assets that can facilitate renewable energy growth. But it requires energy producers and battery owners to think differently.

Making use of other ancillary services, trading on the spot and intraday markets, as well as other benefits related to grid services and balance responsibility are key to ensure new revenue streams. Partnering up with flexibility providers that provide balance responsibility is a good first step to take beyond having an aggregated portfolio in the FCR-D market. As the prices on ancillary services go down, spreading the risk by choosing a BRP (Balance Responsible Party) can make all the difference for market players in the years ahead.

As an active BRP, Flower is offering a wide range of services for its partners that goes beyond relying on the FCR-D market’s price fluctuations. Already allocating volume to the FCR-N instead of FCR-D, Flower’s next step will be to introduce spot- and intraday trading, maximizing the value for energy producers and battery owners.

While renewable energy sources are accelerating on a world-wide scale, energy markets are constantly evolving. By widening the scope and reducing future risk, participating actors can continue to successfully make the most of the ever-changing energy market.

Sources: Varberg Energi, SvK, Europower and internal analysis

Op-ed

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F10%2F22.10.25_John-COP30-01.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FWind-power-Locus-02.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F09%2FFlower-flexibility-dot-com-boom.jpg)

Perspective

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F08%2FOptimization-Market-Leader-Flower.jpg)