The battery race is picking up speed in Sweden. New data from Svenska Kraftnät shows a surge in prequalified batteries in the Swedish market over the past few months. This is a win for the renewable energy transition but may raise concerns for participants in the FCR-D market, where prices are now at a standstill. Looking ahead, is the FCR-D market no longer sufficient? And if so, where should energy producers and battery owners now turn to maximize revenues and reduce risks?

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2024%2F10%2FSkoldinge-BESS.jpg)

The past few months have seen a massive influx of newly prequalified batteries in Sweden. These Battery Energy Storage Systems (BESS), which store energy from renewable sources and release it during peak consumption hours, are crucial for stabilizing the grid and reducing volatility. However, the race to build these new batteries in Sweden, historically driven by high prices in the FCR-D market, is now leading to missed-out revenue opportunities for asset owners.

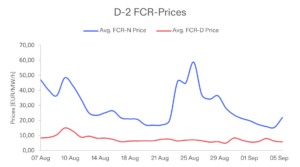

New data from Svenska Kraftnät released in October 2024 now suggests the growth of new batteries in Sweden is continuing, going from 670 to 1020 MW only since the last update on 1st of July. While the reason for the low prices that have been haunting the FCR-D market in the last few months could be traced to steady wind power growth and increased hydropower availability, it’s now becoming increasingly clear that the soaring battery volume is the main driver behind these developments.

Although the FCR-D markets have been instrumental in the past few years bringing unprecedented value to energy producers and battery owners, and enabling a new wave of renewable energy sources in Sweden, the development is proof for how this market is becoming saturated. As of now, there are no signs indicating that the FCR-D prices will increase or be even near the prices seen in 2023. This is, however, a natural progression of the high competition that has been shaping the market. Similar developments have already unfolded in the UK for example. In 2022, ancillary services accounted for as much as 80% of the revenue for battery assets in the country. Now the share of revenue from this market has diminished substantially following low prices and increased competition. As Sweden likely will go that same path, it highlights the importance for asset owners to explore new revenue streams by accessing alternative energy markets in the times ahead.

As FCR-D prices continue to stay at an all-time low, energy producers and battery owners will need to spread their risk in an increasingly competitive market. One certain way of doing this is to enter into partnership with a BRP (Balance Responsible Party) that can provide access to the wholesale markets like the spot and intraday markets. These markets have a completely different market structure than the ancillary markets, making them more resilient to market changes and more stable in generating returns. In the energy markets out in Europe, these markets have been virtually unaffected by the increase of battery volumes compared to the more immature ancillary markets. Wholesale trading is also predicted to represent 60% of total revenues for the batteries that are built today*.

*This data reflects the trend in the more mature UK market. Flower expects the Nordics to follow a similar trajectory in the years ahead.

In Sweden, the FCR-D market could be compared to the more stable FCR-N market. Flower’s battery storage facility in Kungälv, Sweden for example, was used to participate on the FCR-N market instead of the FCR-D market during 6 Aug to 7 sep 2024. As a result, the revenue generated was significantly higher compared to participating only on the FCR-D market during that same period. Going forward, Flower will continue to alleviate risks and maximize returns for partners by allocating more volume to the FCR-N market, as well as open up for new revenue streams by introducing intraday and spot trading.

In the future, energy producers and battery owners will be able to benefit from integrated market optimization solutions that actively seek out the best bidding over several markets. With the new MMO (Multi-Market Optimization) platform, Flower is at the forefront of these developments, accessing multiple energy markets simultaneously and optimizing revenues at every hour on every market. Using this tool, partners will be able to access market opportunities unheard of for the Swedish market.

The evolution of today’s energy market requires asset owners to keep up with constant market fluctuations. The winners in the end will be the ones that take a wide approach and participate in multiple energy markets, maximizing revenues with smart optimization solutions. Although the stagnation of the FCR-D price is reducing revenues in the short run, the future is set to open up a whole new playing field for energy producers, battery owners, and the energy system as we know it.