Are the FCR markets not cutting it on their own? The past year’s rapid battery growth and increasing competition have gradually turned the FCR gold rush into an FCR cool-off. Instead, underpinned by leading-edge automated trading, opportunities are now emerging primarily in wholesale markets such as the day-ahead market. Going forward, what steps can battery owners take to fully capitalize on this new revenue stream?

/https%3A%2F%2Fwww.flower.se%2Fwp-content%2Fuploads%2F2025%2F02%2FELLEVIO.Final-102_web-1000x1246-1.jpg)

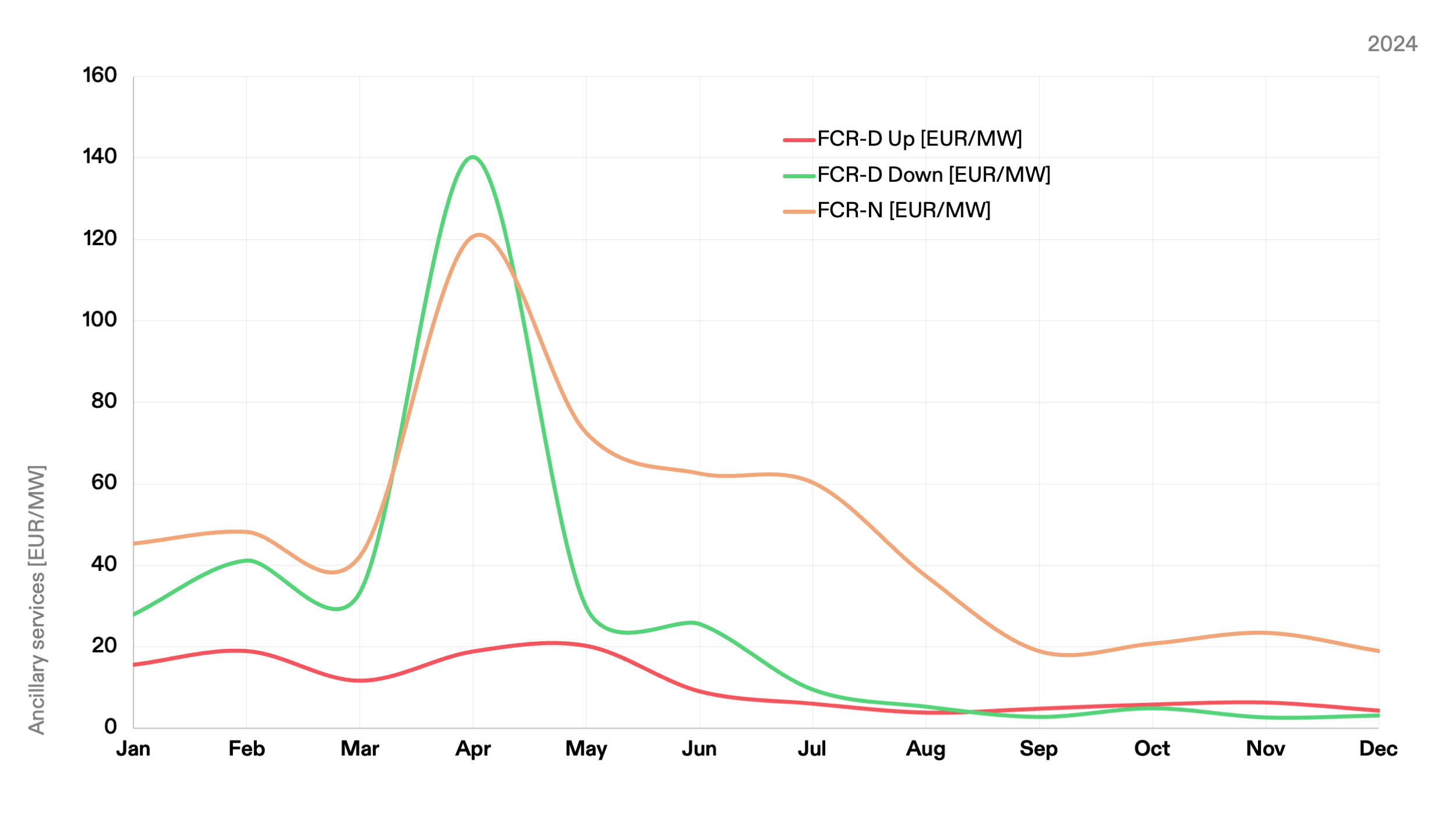

Battery asset owners have experienced a rollercoaster ride in the Swedish energy market over the past few years—shifting from periods of high and stable revenues to record-low prices in the recent year. The average price in the FCR-D Up ancillary market, for instance, peaked at 123 €/MW in 2022, only to drop to current levels of ~4 €/MW in 2025 year to date.

This decline has raised concerns among asset owners, many of whom have started questioning whether their battery storage investments would yield the expected returns. In response, many turned to FCR-N, which has offered higher prices and less competition compared to the FCR-D markets.

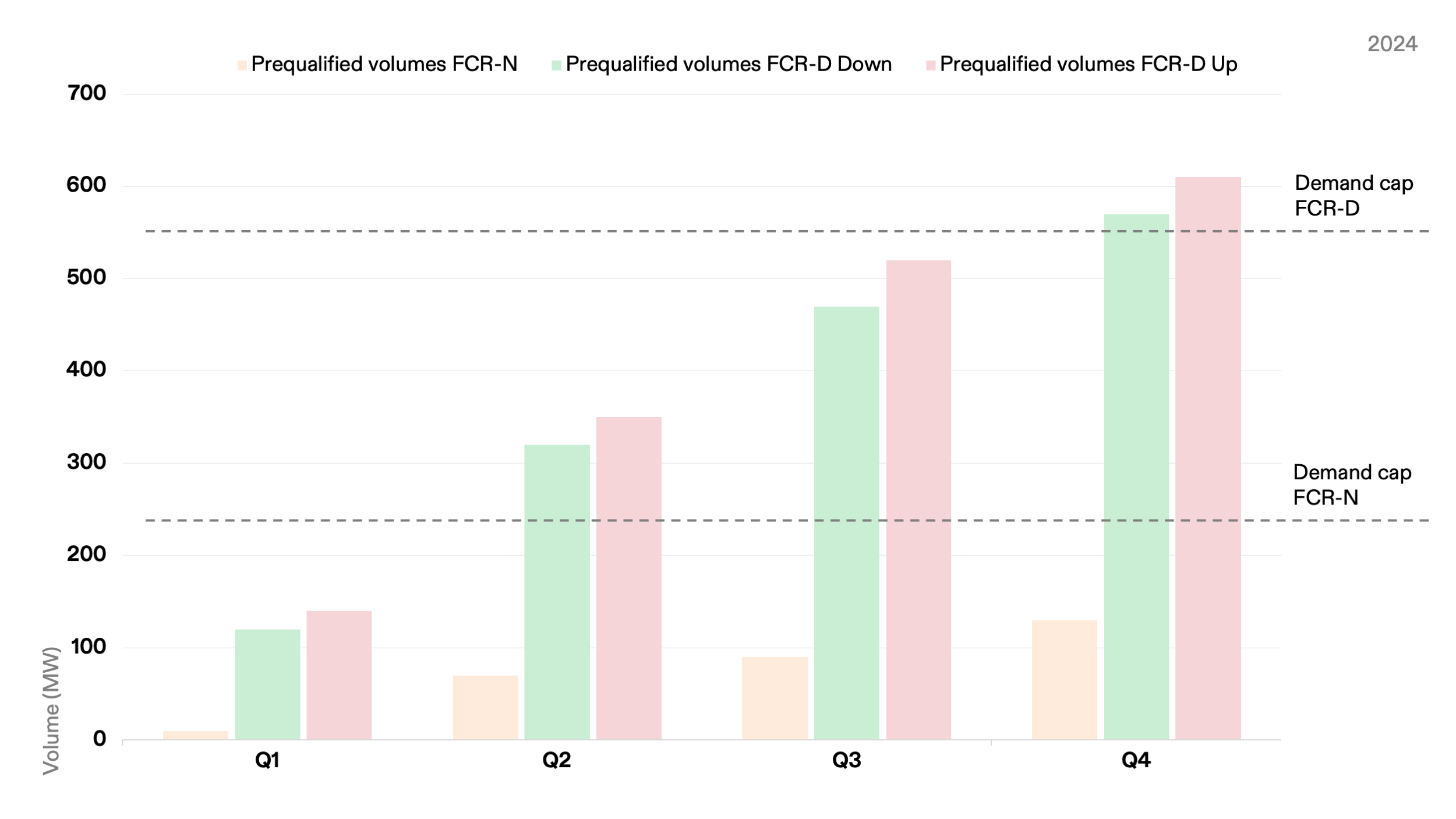

Prequalified BESS volumes in 2024.

As more volume was allocated to FCR-N in 2024, the market expanded rapidly. Over the past year alone, FCR-N grew from 10 MW of prequalified battery storage capacity to over 130 MW in December—a staggering 1300% increase. While this surge initially led to higher revenues for participating actors, the rapid expansion of the market eventually caused average prices to decline—from around 120 €/MW in April 2024 to a steady level of around 20 €/MW since September 2024.

With market trends mirroring last year’s FCR-D stagnation, one pressing question arises: Are FCR markets enough to secure reliable investment returns in the future?

Average prices on the FCR markets in 2024.

The rapid expansion of Battery Energy Storage Systems (BESS) and fixed demand from the Swedish TSO Svenska Kraftnät has created a market saturation in the FCR markets. Though FCR will remain a critical revenue stream for BESS, sophisticated optimizers who are able to allocate their trading between ancillary services and wholesale, like the day-ahead market, are now taking the lead.

In the day-ahead market – an energy market where energy actors buy and sell electricity one day before actual delivery – highly advanced forecasting models and trading algorithms are needed to create substantial value. Earnings can be made by buying cheap electricity when energy is abundant and selling it expensive when energy is in high demand. This generates a profit on the spread while supporting the energy system by making sure energy use is shifted to periods of high demand.

In contrast to the FCR markets, the day-ahead market is characterized by high liquidity and a vast number of buyers and sellers. On average, 16.7 GWh was bought and sold every hour on the day-ahead market between November and January. During that same period, around 1.4 GW was procured per hour for ancillary services by Svenska Kraftnät. In the most advanced energy markets globally, wholesale markets are expected to account for approximately 60% of revenue streams for batteries that are built today*. This development implies that market players who are at the forefront of automated trading and are able to optimize its portfolio to drive revenue in these markets will be the ones that excel.

*This data reflects the trend in the more mature UK market. Flower expects the Nordics to follow a similar trajectory in the years ahead.

To better understand how automated trading on wholesale markets can be optimized for BESS, an illustrative example from Flower’s portfolio can be used.

During one day in January, 2025, a volatile pricing period created significant arbitrage opportunities for this asset in the day-ahead market. By the end of the day, Flower’s trading realized a price spread of approximately 200 €/MWh, leading to:

As a result, 70% of that day’s total revenue came from trading in the day-ahead market—demonstrating the importance of excelling in the wholesale markets.

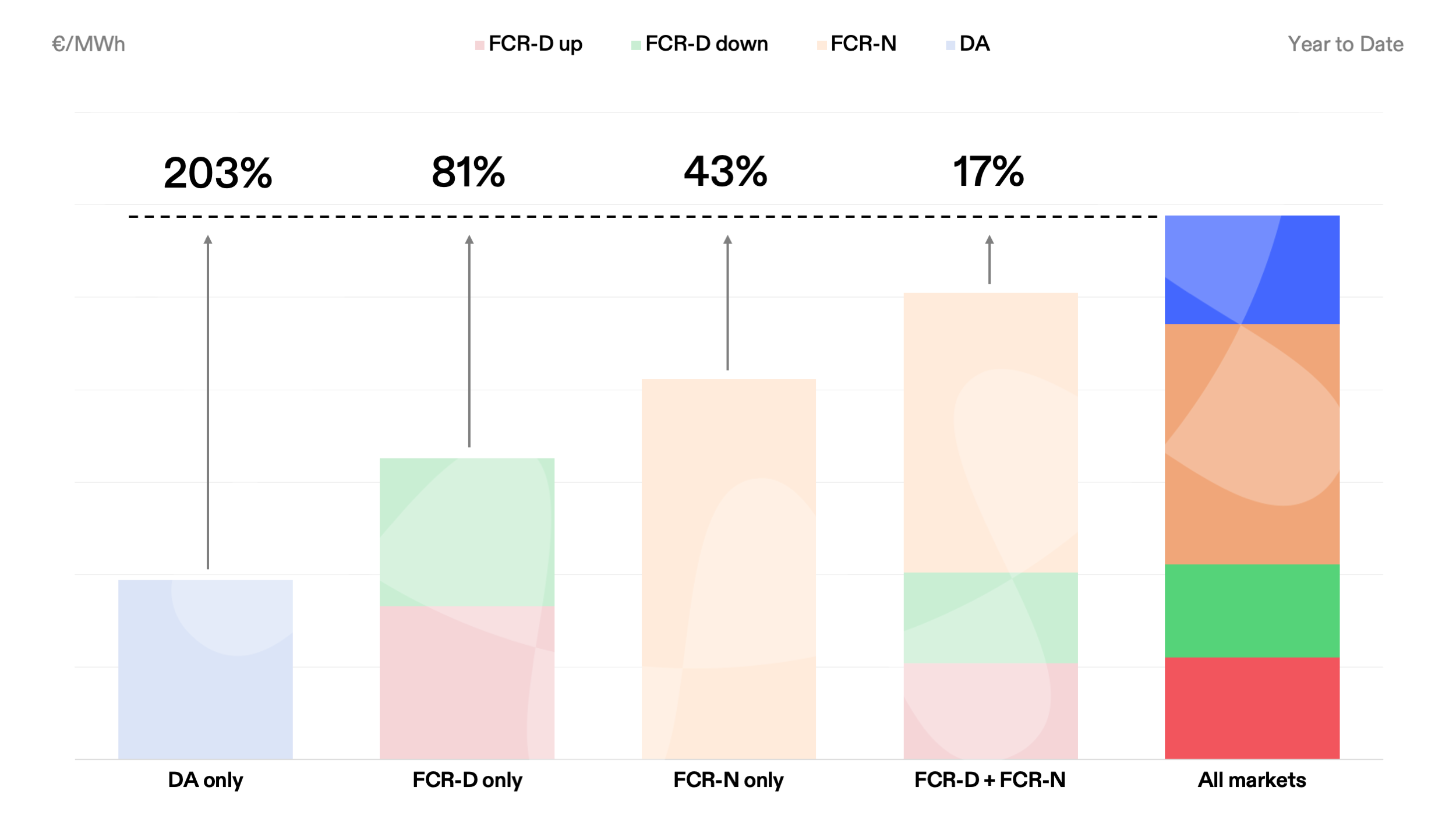

With a team of over 40 in-house experts dedicated to perfecting and refining its trading algorithms, Flower has developed a model for backtesting optimal market allocation. This model is designed to continuously train and improve its trading software. When using this model to examine the total revenue potential for 2025 Year to Date, the importance of understanding and optimizing between all markets becomes increasingly clear.

Backtested optimal market allocation for 2025 YTD, €/MWh.

Backtesting Flower’s optimization model with different market configurations shows that more markets yield better returns. FCR-N still reigns supreme among single-market strategies, but combining with FCR-D improves returns by 23% and adding day-ahead trading results in further improvement of 17%. In line with this trend, Flower’s most recent February numbers for all assets show significant value creation compared to FCR-D and FCR-N. However, there is more than market participation required to realize the revenue potential.

While the FCR markets have provided stable revenue streams in the past, they will not be sufficient on their own to ensure long-term profitability in the future. This is why participating in the wholesale market will be essential going forward, which is only possible through a partnership with a Balance Responsible Party (BRP). However, to reap the full benefits of the wholesale revenue streams, cutting-edge expertise in automated trading is crucial. This is particularly the case when it comes to cross-market optimization and predictions of large revenue opportunities that make the business case come together.

As a BRP, and with market-leading trading algorithms specifically designed to optimize returns and minimize risks, Flower is already allocating a large share of its portfolio to wholesale arbitrage while excelling in cross-market optimization. With a large and growing trading domain, perfecting and refining its forecasting, trading and optimization platform, Flower is continuing to diversify market participation and enhance value creation while positioning itself at the forefront of the energy trading sphere.

Get in touch with us to learn more about our work.